May 7, 2025

Curious about the future of tech jobs in a world transformed by AI? Discover the surprising growth trends, in-demand skills, and salary projections that are shaping the careers of software and data professionals in 2025! Don’t miss out on insights that could redefine your career path!

The tech job market shows strong demand for specialized skills with projected job growth of 17-36% by 2033, high salaries for AI/data roles, and a shift towards hybrid work models. But experienced professionals are favored, creating challenges for entry-level candidates.

Despite moderating from pandemic peaks, specialized roles in AI, cloud, and data engineering remain in high demand. Companies seek professionals combining technical and business skills, especially in generative AI and MLOps.

Experienced professionals with proven digital transformation impact are particularly valuable.

2025 Tech Job Market Analysis: Software & Data Professionals

Executive Summary

- Mixed landscape: Strong demand for specialized tech skills despite market softening in some areas

- Growth projection: 17-36% job growth rates across tech roles (2023-2033), exceeding most sectors

- Salary trends: Premium compensation continues, especially for AI/ML and data specialists

- Remote work: Stabilizing at 18% fully remote, 30% hybrid, 52% in-office for tech roles

- Key challenge: Market favors experienced professionals over entry-level candidates

Market Overview

- Current state: Software job postings down 33% from 2020 peak, representing largest boom-bust cycle

- Employment context: Tech unemployment rates remain well below national average (4.1%)

- Software developers: 2.2% unemployment

- Systems analysts: 2.0%

- IT support specialists: 1.6%

- Database administrators: 1.5%

- Security analysts: 1.4%

- Network architects: 0.3%

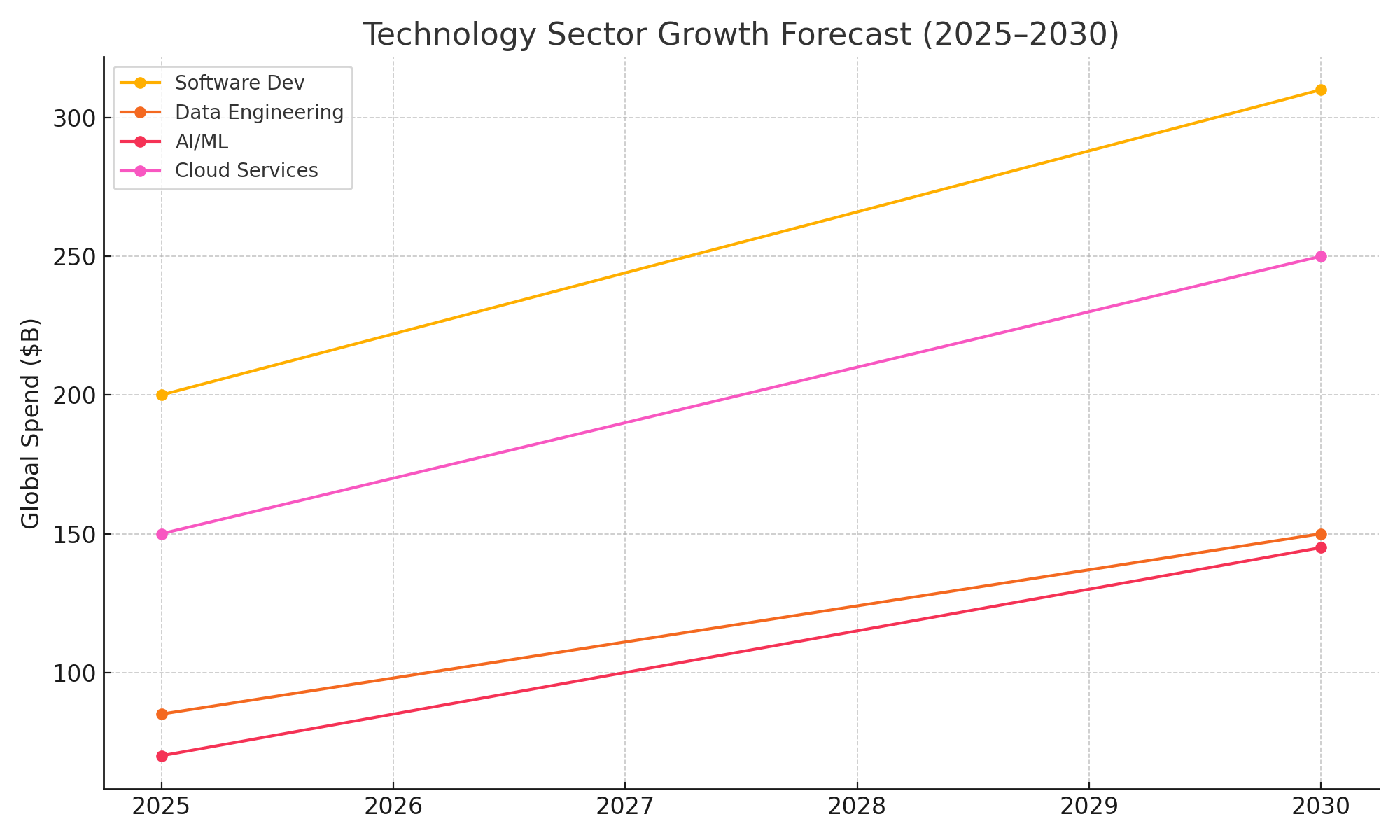

- Market size: U.S. spending on software engineering projected to reach $200B in 2025

- Annual growth: Global tech spending projected at 14% year-over-year

xychart-beta

title "Software Developer Job Postings 2020-2025 (Indexed to 2020=100)"

x-axis [2020, 2021, 2022, 2023, 2024, 2025]

y-axis "Job Postings Index" 60 --> 120

line [100, 115, 120, 95, 75, 67]

Salary Trends by Role

Table 1: 2025 Salary Ranges by Role and Experience Level

| Role | Entry-Level | Mid-Level | Senior-Level |

|---|---|---|---|

| Software Developer | $99,500-$120,000 | $120,000-$160,000 | $160,000-$200,000+ |

| Software Engineer (Big Tech) | $120,000-$150,000 | $150,000-$190,000 | $190,000-$251,000+ |

| Software Architect | $81,464-$100,000 | $107,714-$154,303 | $170,000-$206,000 |

| Data Engineer | $90,000-$117,000 | $117,873-$150,488 | $150,000-$197,000 |

| Data Scientist | $95,000-$130,000 | $130,541-$177,342 | $175,000-$230,000 |

Table 2: Major Tech Company Average Engineer Salaries (2025)

| Company | Average Annual Salary |

|---|---|

| $251,215 | |

| Amazon | $188,436 |

| Meta | $171,553 |

| Microsoft | Comparable to industry leaders |

| Apple | Comparable to industry leaders |

pie title Data Scientist Salary Distribution 2025

"$160K-$200K" : 32

"$120K-$160K" : 27

"$200K+" : 18

"$100K-$120K" : 14

"Under $100K" : 9

Job Growth Projections

Table 3: Job Growth Forecasts by Role

| Role | Projected Growth | Period | Source |

|---|---|---|---|

| Software Developers/QA | 17% | 2023-2033 | U.S. BLS |

| Software Engineers | 21% | 2018-2028 | U.S. BLS |

| Software Architects | 21% | 2018-2028 | Industry Analysis |

| Data Engineers | 400% increase in job postings | Past 5 years | Industry Analysis |

| Data Scientists | 36% | 2022-2032 | U.S. BLS |

xychart-beta

title "Job Growth Rates vs. National Average (3.7%)"

x-axis ["Software Dev", "Software Eng", "SW Architect", "Data Engineer", "Data Scientist", "National Avg"]

y-axis "Growth Rate (%)" 0 --> 40

bar [17, 21, 21, 25, 36, 3.7]

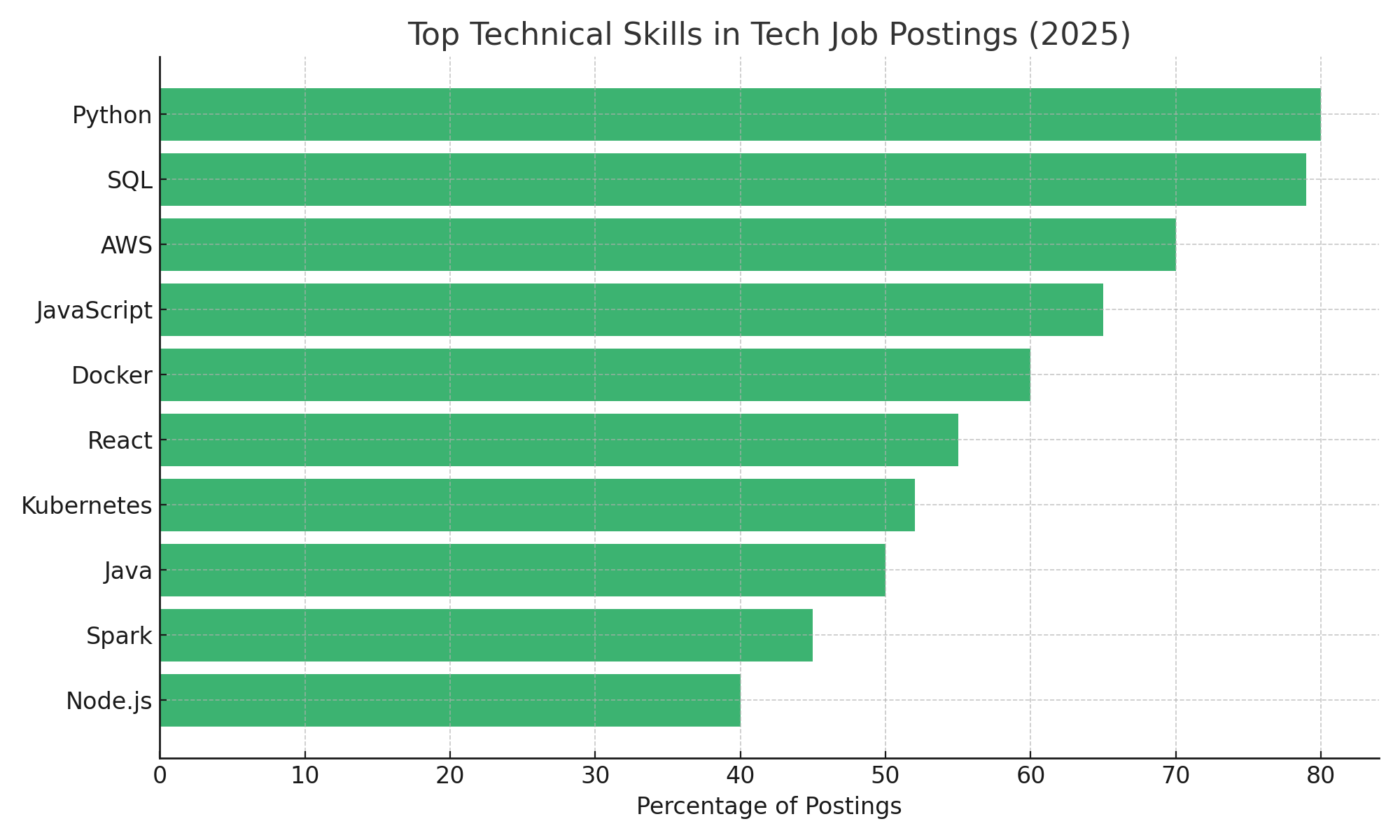

In-Demand Skills by Role

Software Developers & Engineers

- Core languages: Java, Python, JavaScript, C++, C#

- Database: SQL, NoSQL, MongoDB

- Frontend: React.js, Angular.js, Next.js

- Backend: Node.js, Django, Spring Boot, Express.js

- Cloud: AWS, Google Cloud, Microsoft Azure

- DevOps: Docker, Kubernetes, CI/CD pipelines

- Emerging: AI/ML integration capabilities

Software Architects

- Core competencies: Software architecture, system design, scalability planning

- Technologies: .NET, C#, Java, SQL, AWS, Azure, ASP.NET

- Soft skills: Communication, leadership, stakeholder management

- Specializations: Cloud architecture, security architecture, solution architecture

Data Engineers

- Languages: SQL (79.4% of postings), Python (73.7% of postings)

- Platforms: Microsoft Azure (74.5% of postings)

- Big data: Hadoop, Spark, Kafka, Kinesis

- Cloud data services: Redshift, Snowflake, BigQuery

- ETL/ELT: Designing data pipelines, transformation workflows

Data Scientists

- Core skills: Machine learning (77% of postings), statistical analysis

- Data tasks: Data visualization, data mining, predictive modeling

- Specializations: NLP, computer vision, deep learning

- Business skills: Translating data insights to business value

- Tools: Python, R, TensorFlow, PyTorch

xychart-beta

title "Most Demanded Technical Skills in 2025"

x-axis ["Python", "SQL", "AWS", "Java", "Azure", "JavaScript", "React", "ML/AI", "Kubernetes", "TensorFlow"]

y-axis "Demand (% of job postings)" 0 --> 100

bar [75, 79, 65, 60, 55, 50, 45, 40, 35, 30]

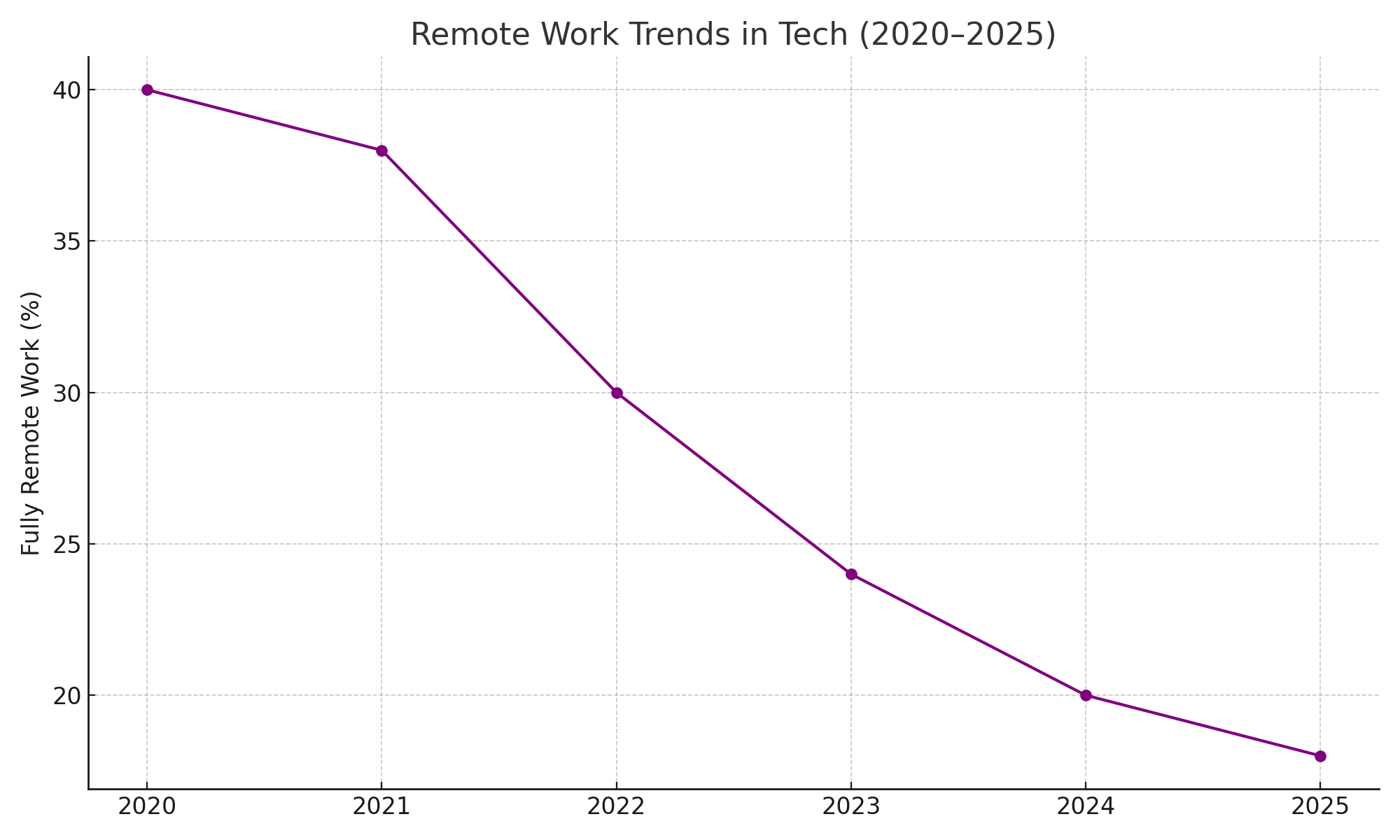

Remote Work Trends

Table 4: Remote Work Distribution in Technology Sector (2025)

| Work Model | Percentage of Job Postings |

|---|---|

| Fully On-site | 50-54% |

| Hybrid | 28-30% |

| Fully Remote | 18-20% |

Table 5: Remote Work by Experience Level (2025)

| Experience Level | Hybrid | Fully Remote |

|---|---|---|

| Senior-level (5+ years) | 30% | 16% |

| Mid-level (2-5 years) | 25% | 13% |

| Entry-level (<2 years) | 23% | 11% |

- Future projection: Global digital remote jobs expected to increase 25% by 2030 (to 92M jobs)

- Performance impact: Remote work shows 13% performance improvement, 50% reduction in quit rates

- Industry differences: Technology leads in remote opportunities (18% fully remote vs. 8% in legal sector)

xychart-beta

title "Remote Work Evolution 2020-2025"

x-axis [2020, 2021, 2022, 2023, 2024, 2025]

y-axis "Percentage of Tech Workforce" 0 --> 100

line [20, 70, 60, 45, 35, 28]

line [5, 15, 25, 30, 32, 30]

line [75, 15, 15, 25, 33, 42]

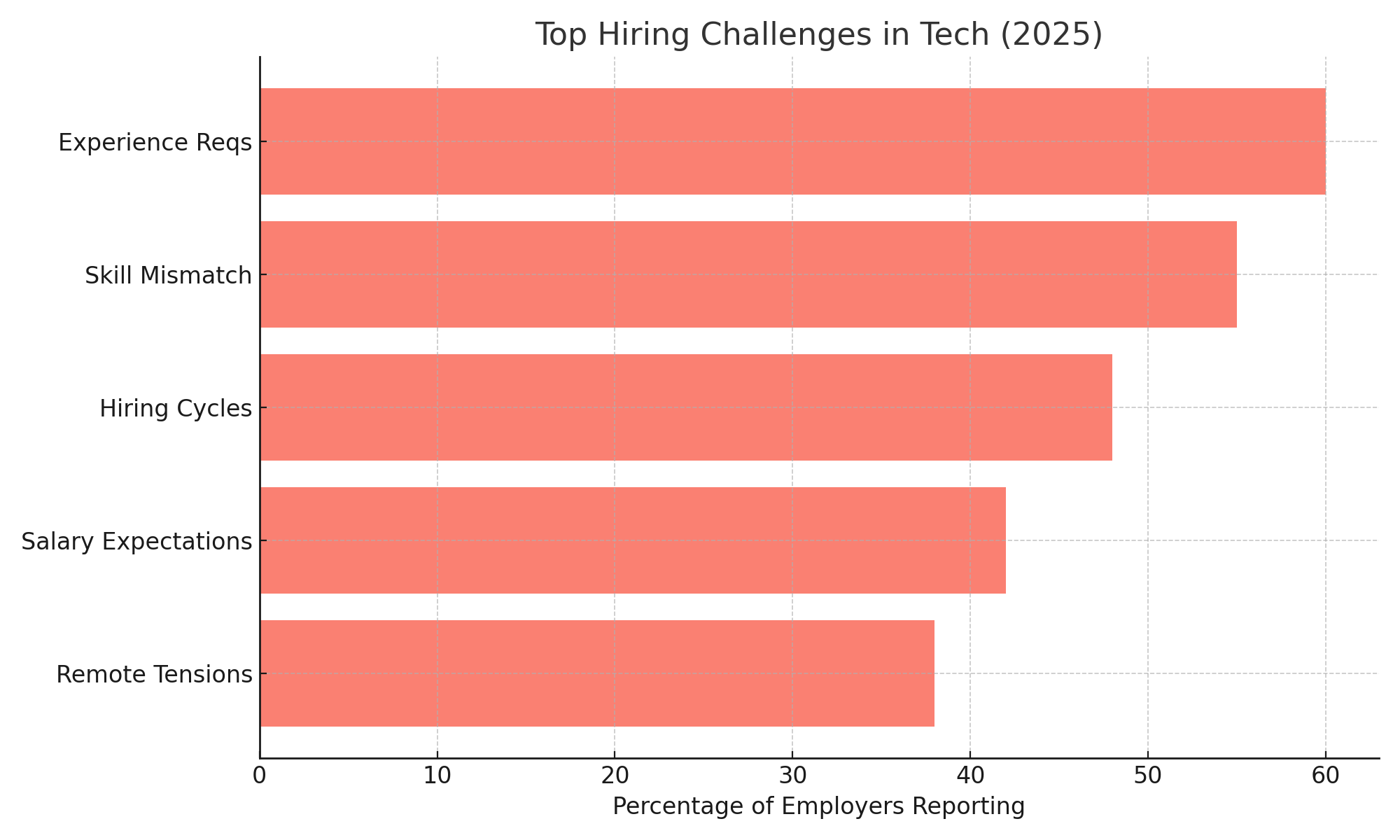

Hiring Challenges

- Experience expectations:

- Market favors mid/senior-level professionals who can contribute immediately

- Entry-level professionals without elite academic credentials face higher barriers

- Bootcamp graduates face decreased opportunities compared to previous years

- Skills expectations:

- Engineers expected to set up, scale, and maintain complex applications from day one

- 57% of data science postings seek “versatile professionals” with cross-domain expertise

- Expectation for AI tool integration capabilities across all roles

- Hiring process:

- Longer hiring timelines

- Multiple competing offers required for negotiating leverage

- Increased focus on proven career trajectory

- Work model tensions:

- Companies expect more office presence (2-3 days/week minimum)

- 47% of IT workers still prioritize location flexibility in job decisions

- Senior roles retain more remote flexibility than junior positions

xychart-beta

title "Top Hiring Challenges for Tech Roles (2025)"

x-axis ["Finding experienced talent", "Salary expectations", "Skills gap", "Remote work policy", "Competition"]

y-axis "Significance (1-10)" 0 --> 10

bar [8.5, 7.8, 7.2, 6.5, 6.2]

Future Outlook

- AI integration: Creating new roles rather than eliminating existing ones

- Skill evolution:

- Software Engineering Intelligence (SEI) emerging as key domain

- Low-code/no-code platforms expected in 70% of app development by 2025

- Cloud engineering demand increasing across all sectors

- Market dynamics:

- Technology market stabilizing after post-pandemic correction

- Big Tech hiring more selectively but still offering premium compensation

- Global opportunities expanding through remote digital jobs

- Workforce changes:

- Higher-wage roles ($75,000+) dominating future remote digital jobs

- Increased emphasis on specialized certifications

- Growing preference for demonstrated expertise over formal education

Key Takeaways

- Overall market: Favorable outlook despite correction from pandemic-era hiring boom

- Compensation: Remains strong, especially for specialized skills and experienced professionals

- Growth areas: AI/ML, cloud engineering, data science, and cybersecurity lead demand

- Work models: Hybrid emerging as dominant approach, balancing flexibility with collaboration

- Career strategy: Specialization, continuous skill development, and demonstrated value critical for success

Apache Spark Training

Kafka Tutorial

Akka Consulting

Cassandra Training

AWS Cassandra Database Support

Kafka Support Pricing

Cassandra Database Support Pricing

Non-stop Cassandra

Watchdog

Advantages of using Cloudurable™

Cassandra Consulting

Cloudurable™| Guide to AWS Cassandra Deploy

Cloudurable™| AWS Cassandra Guidelines and Notes

Free guide to deploying Cassandra on AWS

Kafka Training

Kafka Consulting

DynamoDB Training

DynamoDB Consulting

Kinesis Training

Kinesis Consulting

Kafka Tutorial PDF

Kubernetes Security Training

Redis Consulting

Redis Training

ElasticSearch / ELK Consulting

ElasticSearch Training

InfluxDB/TICK Training TICK Consulting